An alliance of regional banks and community organisations has provided Treasury with a detailed plan to ensure the sustainability of essential face-to- face regional bank branches, amid a continued crisis of branch closures across Australia.

The Regional Banking Investment Alliance (RBIA) said the modest and easily implementable plan involves an industry community service obligation (CSO) which links to regional banking jobs and helps cover costs for face-to-face branch services.

The CSO initiative would be funded by the banking industry via existing financial sector levies and amount to around $153 million, or 0.17 per cent of the total operating income of the major banks. Under the proposal, smaller banks (with less than 1 per cent of industry assets) would be able to opt out.

“A remedy is urgently needed to stem the closure of bank branches across Australia,” Alliance spokesperson and CEO of Regional Australia Bank, David Heine said. “Our CSO proposal involves a direct contribution to any bank which maintains or expands regional bank branches.

“It would ensure ongoing support to preserve the financial viability of existing branches and incentivise banks to invest in new ones.”

“To be effective, the CSO must make a meaningful contribution to the running costs of a regional branch but not be so significant as to undermine market forces and competition.”

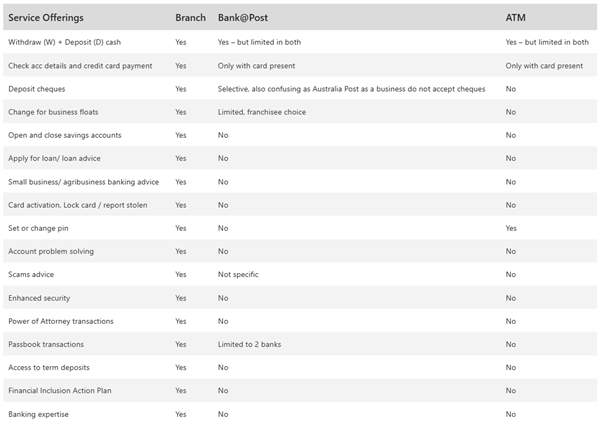

Under the RBIA proposal, bank branches receiving the CSO contribution would need to meet criteria that the community generally expects from retail branch services, such as cash handling, home loans, transaction accounts, and term deposit management, as well as trained staff to offer advice and support.

The contribution would be directly linked to trained full time employees, ensuring face-to-face services are maintained.

Some members of the RBIA have already indicated they would open new branches if the model was adopted.

“For the purposes of defining a branch for eligibility for a CSO contribution, it is essential that banks only include those branches providing trained face to face core retail services, including cash management services,” Mr Heine said.

“As trained face-to-face services are the main reason why branch services are valued and demanded by regional communities, it is essential to directly link subsidies to the number of employees in a branch.”

Like what you’re reading? Support New England Times by making a small contribution today and help us keep delivering local news paywall-free. Donate now