The first New England Times Poll has found that more than half of the people surveyed were concerned about bank branch closures, and 45% preferred to sort out problems in the branch.

246 people participated in the poll from all areas of New England, which was not too bad for our first poll but is a little on the low side statistically speaking, meaning there is a bit of an error margin in these figures.

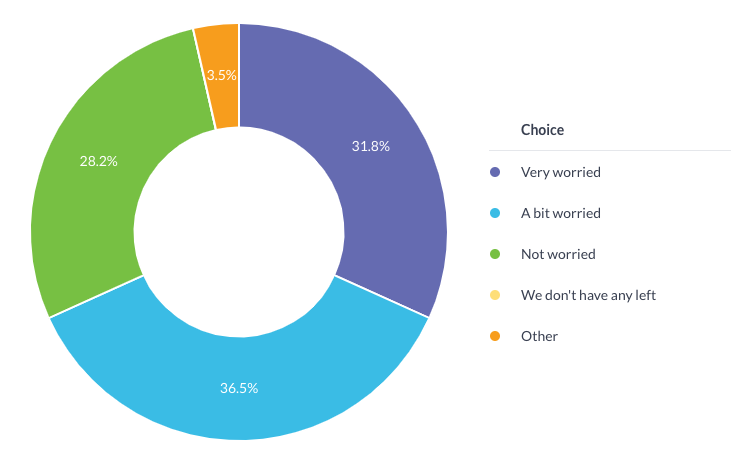

There were three questions. The first asked how concerned people were about bank branch closures.

68% of respondents were very worried or a bit worried about bank closures, while 28% were not worried. Many commented that they weren’t worried as long as there was an alternative.

“I’m not worried as long as there’s a way of paying in the odd cheque I might receive once or twice a year.”

“There is a genuine option for face to face banking in most New England towns by banking at a customer owned bank such as Regional Australia Bank or Northern Inland Credit Union.”

“I worry about banks closing and leaving customers little options. The ANZ closed in Kempsey and given they don’t have Bank@Post (Australia Post banking), accountholders could no longer deposit cash unless they went to the next town.”

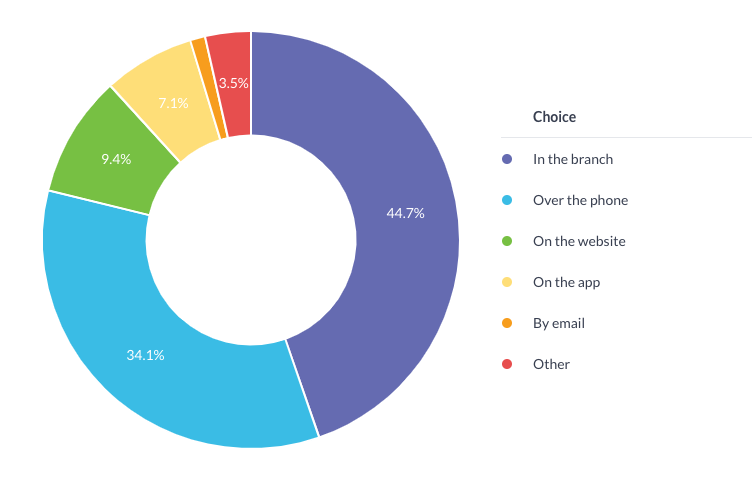

The second question asked how people liked to deal with the bank when there is a problem. Note, we intentionally worded the question to focus on what happens when something goes wrong – yeah, most people bank online or other non-face-to-face way, but it’s when things go wrong that tells the most about how people use services.

45% said they sort out problems in the branch, and 34% did it by phone. A number of respondents said they had a ‘relationship banker’ or ‘direct banker’ who seems to have the authority bank branch managers used to have to sort issues for their customers… and even if they called or went into a branch, this banker would need to authorise the action to fix any problem anyway. For some, they would approach the problem differently depending on the bank they were dealing with.

“I contact RAB by phone, because I can still get helpful service that way. CBA I go into the branch, to save phone queues and talking with institutionalised service staff, or trawling through endless web pages.”

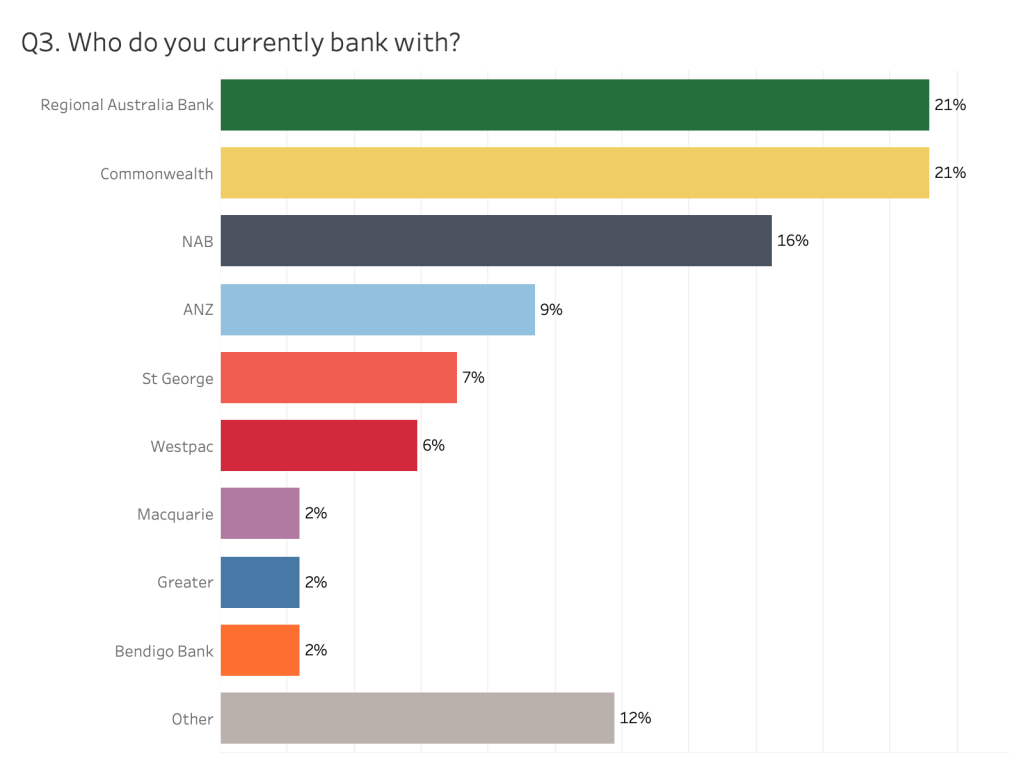

And the third question asked who people currently bank with. This question was to find out if New Englanders were voting with their feet and choosing to bank with those keeping the branches open – and the results were pretty clarifying as to why Westpac/St George and ANZ are leading the way in branch closures.

21% of respondents banked with Armidale based Regional Australia Bank (formerly the New England Credit Union), in a dead heat for first with the Commonwealth Bank also on 21%. There was a clear age split however, with the Commonwealth customers being mostly older people, and RAB having a more even age range. 30% banked with one of the other big 4: 16% were with NAB, 13% with Westpac or St George (combined), and just 9% with ANZ. Macquarie, Bendigo, Greater, and a variety of smaller banks, credit unions and mutuals also had a small share of customers each.

Regional Australia Bank customers were the most generous in their praise:

“RAB is excellent. Low fees. great service for more than 30 years.”

“We are pleased that we are with the Regional Australia Bank as they have a strong local focus.”

Thank you to everyone who participated in our first poll! This weeks poll is on the proposal for a university campus in Tamworth.

Take this week’s poll now: https://s.surveyplanet.com/kdt91dsk

Got something you want to say about this story? Have your say on our opinion and comment hub, New England Times Engage